Financial Analysis to

Inform your Investment Decisions

Working out whether or not a real estate investment is right for you is complicated.

To make matters worse, real estate agents selling you a property have no interest in

helping you; they get paid whether or not you make money!

It can be complicated…

When it comes to real estate investment, there are many reasons why it’s difficult for investors to determine whether an investment is right for them. It becomes even more complicated when investors consider potential investments in different countries.

International Market

If you’re considering an offshore property investment, you’ll probably be comparing different countries to see what works best for you, the reality is that everywhere is different.

Tax deductible expenses and applicable taxes:

What do you need to know?

Without running detailed financial models, you risk making a costly mistake if you buy the wrong property but it can be difficult to ascertain the right information to capture to determine the right investment for you. Having an understanding of stamp duty, estimated yields, monthly mortgage payments and anticipated service charges is not enough to base your decisions on.

At MyPropTech we believe there are six measures that all investors need so you can determine which property best meets your investment objectives.

Cash required

How much cash is required to purchase the investment?

Net cash flow

How much cash will an investment generate after covering costs?

Net income after tax

How much income is left after paying tax?

Capital appreciation

How much capital appreciation will the investment generate?

Available equity

How much available equity is your property generating which you can reinvest in other properties to grow your portfolio?

Net Return on Investment

How much net income does the investment return, relative to the cash required?

Financial Models, Tools and

Calculators... built for you

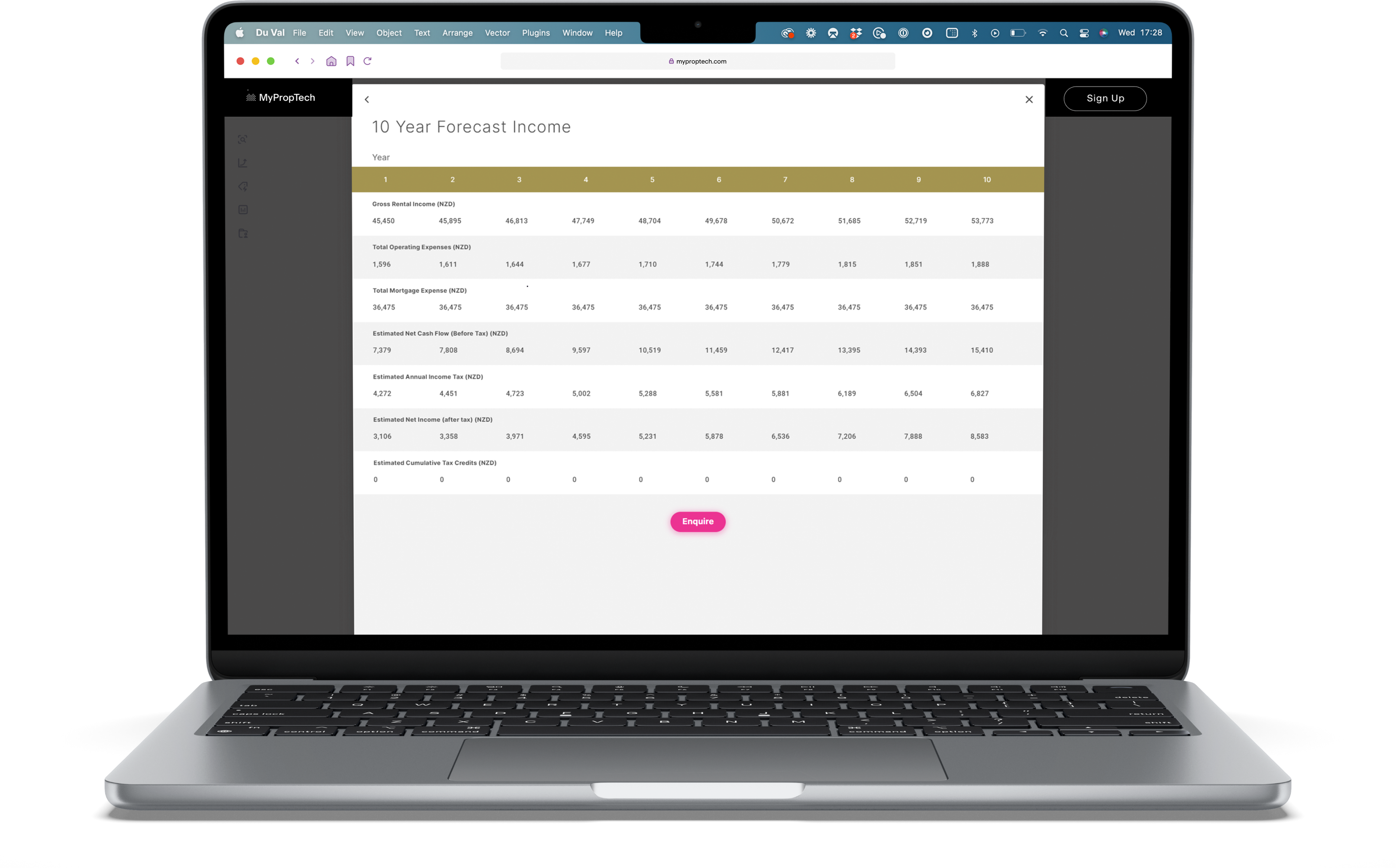

We’ve built a series of sophisticated yet intuitive tools and calculators so that you can determine an investment’s viability, and forecast the net return after tax, equity position, and return on cash.

MyPropTech guides you through the calculators, creating a bespoke financial forecast with granular detail. With the results, you’ll be able to invest with clarity.