MyPropTech Dynamic Pricing

MyPropTech is a better way for investors to buy property. By utilising our

proprietary technology and leveraging economies of scale, we enable our members

to buy apartments from the world’s leading developers at the lowest possible price.

How does it work?

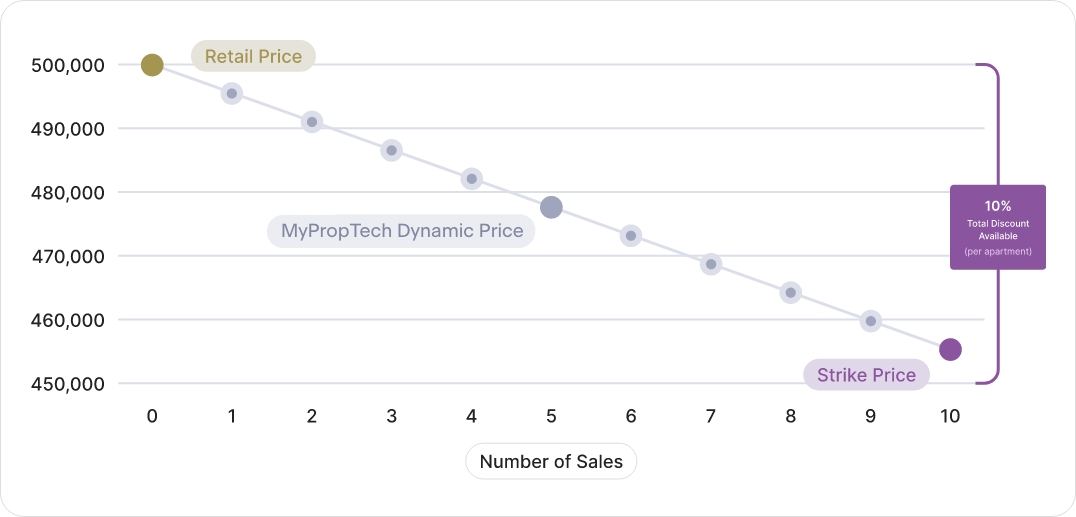

We negotiate terms with a developer to sell an allocation of property in their development to our members who all exchange contracts simultaneously. In the same way developers would sell part or all of their development to an institutional large investor, this is often referred to as a ‘bulk deal’. The logic behind this approach is simple, like everything else the more you buy of a product the better the deal you get.

As more properties are sold, the price drops...

...and after 30 days there are only two possible outcomes:

Strike Price is not achieved

- We’re sorry but not enough other members reserved properties in this development.

- We’ll refund your Reservation Fee in full.

Strike Price is achieved

- Great news! We’ve reached the minimum target needed to unlock the Strike Price.

- Your Reservation Fee becomes non-refundable.

- You have 7-Days to exchange contracts with the developer.

Here are some of the most common questions we get asked.

- Am I buying a whole apartment, or buying a share of an apartment?

- Do I get a better discount if I reserve more than one unit?

- How will I know if the property has reached the Strike Price?

- Are MyPropTech underwriting the development?

Where did it start?

Currently investors go through an antiquated system when they buy investment property. Property agents promote real estate through international property exhibitions and marketing events.

Promoting real estate developments at property exhibitions was an effective way to generate awareness and sell property in the 2000’s. At that time, appreciation of offshore investment was relatively low and technology was not available to facilitate real estate transactions.

Since that time, the world has moved on... but property marketeers have not changed and have kept on repeating the same format of property exhibitions. As more and more agents operate in the space, the expense has increased and ultimately someone has to pay the bill. The problem for investors is that it’s always the end purchaser who pays. Based on analysis, marketing through property exhibitions adds between USD 25,000 – USD 50,000 to the price of a property!

Investors deserve a better solution. Property developers want a better solution. Technology gives us the ability to eliminate this waste and build long-term relationships with investors that property agents just don’t care about.

We knew there was a better way.

The Residential Developer’s Dilemma

Residential developers manage a series of ‘risks’ when they develop new residential developments:

Land Risk

Planning risk

Construction risk

Sales risk

Funding risk

These risks form their total cost of developing a new property. The difference between the costs and the price of the property is the developer's profit.

How much profit the developer is looking to achieve is directly related to how much risk they are taking. Therefore, the more the risk is mitigated, the more willing they are to accept a lower price for the property.

As a real estate investor the only risk you can reduce for a developer is their sales risk – everything else is beyond your control.

Sales Risk

Residential development is hugely capital intensive and very risky, many things can go wrong. Most developers need to sell between 30% - 50% of a building before they are able to start construction.

Developers typically have two options:

Forward Sale

Sell the whole building to a large investor:

Low Risk

These investors are known to the developers and don’t require expensive marketing campaigns and collateral.

Low Return

The downside is that these institutions command large discounts from the sales price.

Retail Sale

Sell to a large number of smaller individual buyers:

High Risk

The marketing costs to reach these buyers are extremely high.

High Return

The discounts offered to these individuals are far less than those given to large investors.

However the problem is that not all investors and buyers behave in the same way.

Institutional Investors

International Investors

Retail Investors

Owner Occupiers

In order for a developer to unlock funding to build a development and achieve the best possible return on their capital, most have little choice but to look off-shore for international investors. These are the only buyers willing and able to purchase off-plan and help underwrite the developer’s development risk.

In order for a developer to unlock funding to build a development and achieve the best possible return on their capital, most have little choice but to look off-shore for international investors. These are the only buyers willing and able to purchase off-plan and help underwrite the developer’s development risk.

The Status Quo

At the moment developers, have little choice but to promote their projects internationally using international property agents, who hold property exhibitions in lavish hotels in major centres across Asia and the Middle East.

These property agents create ‘pressure cooker’ events where they entice would-be investors to purchase an investment over a weekend before the opportunity is gone!

The issue for both investors and developers is that the average property exhibition costs around USD 300,000 (per event), taking into account the cost of promotion, hiring the space and sales and marketing materials. These costs are ultimately passed on to the investor when they purchase a property, or they’re borne by the developer if they don’t sell any property at the event.

Developer

- Has limited options for reaching buyers

- Bears the cost and risk for selling properties off-plan

Property Agent

- Has to take risk

- Is incentivised to sell as much property as possible

Investor

- Has no negotiating power

- Ultimately pay sales and marketing costs in the purchase price

At MyPropTech, we know there is a better way. We created MyPropTech Dynamic Pricing, which creates economies of scale where both developers and investors benefit. We believe, by removing the risk and cost for developers and investors and passing savings on to investors, everyone can win.

The best deal is created when: